9 things to look for to get more with your Direct Debit processing

Regular giving remains vital to sustainable fundraising

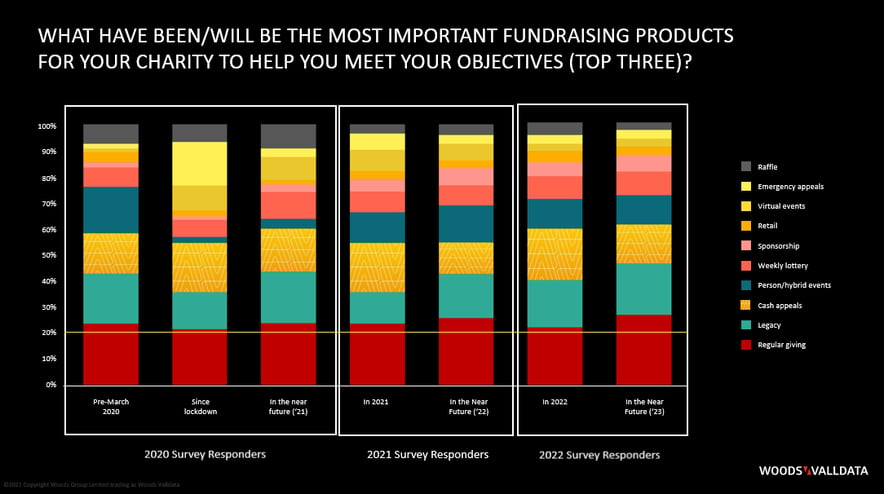

Regular giving is the mainstay of most fundraising programmes. It’s a sustainable, predictable income source for your charity. In fact, in the 2022 Woods Valldata Individual Giving Fundraising Survey, it accounts for more than 20% of the top most important fundraising products across the sector year on year.

Given its ongoing importance, is your Direct Debit bureau giving you extra?

Are you getting the best DD service from your current provider? It’s surprisingly easy to migrate your direct debits to an alternative provider. Here’s nine things to look out for to ensure you’re getting maximum benefit, and if you’re not getting them, perhaps it’s time to think about a change.

What to expect from your outsourced direct debit provider

All DD bureaus should have the following as standard:

1. Registration with Bacs

Registration with Bacs is a given requirement when working with a Direct debit bureau. Check they’re an accredited bureau and comply with all requirements to protect your charity income and your supporters.

2. UK GDPR Compliance

Compliance to UK GDPR is a legal requirement that protects your charity and your supporters’ personal data. How is your current provider complying with requirements? Are they simply ticking boxes or going over and above to ensure your supporters and therefore your charity get the best possible experience? Woods Valldata systems are HTTPS enforced and annually penetration tested to ensure maximum security for your supporter data. Plus we’re compliant and annually audited by ISO, Bacs, the Gambling Commission and PCI DSS.

3. Multiple sign up, upgrades and reactivations from a variety of sources

Regardless of channel, your direct debit management provider should be offering seamless integration of direct capture and third-party imports. The speed and accuracy of this service is of paramount importance. You need to know that each and every supporter DD is managed with the supporter experience in mind – and getting it right from the start is the first step in that process.

4. Reporting

Knowing what’s gone into your regular giving each payment round is essential for your internal reporting, database management and reconciliation. Your service provider should be providing these on a regular basis as a minimum. A great provider will be able to give you options as to the types of report you’d like concerning your Bacs submissions by channel and stage.

The additional benefits of migrating to Woods Valldata for your direct debits

In addition to this, you should look out for the following services linked to managing your DDs:

5. Modulus checking

Get the DD right first time with modulus checking. This means that your supporters’ bank details are checked to validate and verify the account number and sort code. At Woods Valldata, if they don’t tally, we work with the supporter via automatically triggered communications to let them know and to get their DD set up quickly and efficiently.

6. Tailored Bacs reporting

ARUDDs, ADDACs, AUDDIS are acronyms you’ll know well if you’re involved in DD processing. They’re essential in the management of DDs and can be a lot to manage when you’re operating DDs in house. To reduce error, the Woods Valldata system automatically downloads Bacs reports and updates, amends or cancels the DD depending on the Bacs reject reason. We’ll ensure the reject process is tailored to your requirements including getting the right customer service letter out to your supporters where relevant – or re-attempting subsequent payments.

7. Flexible thanking matrices and triggered communications.

The supporter experience is essential in DDs. And one of the areas that gets missed regularly is thanking as part of a systematic supporter journey.

You need to get your advance notice letters (ANLs) out according to Bacs lead times, of course, but are you taking advantage of the opportunity to add value to this process? Sending welcome information in addition to your ANL letter or email reassures supporters that they’re making the right decision and reduces attrition – getting your supporter journeys off to the right start.

What’s more, with Woods Valldata managing the DD process, you get the same level of thanking and personalisation you have with your other appeal handling. That means complex thanking matrices adding additional relevance to the supporter and automatic triggered communications coming in at key milestone points known to increase loyalty and suppress attrition by up to 12%. It’s great because once it’s set up, it just keeps working for you without you having to think about it!

8. Live access to your DD data with flexible giving options

Expectations from the public are getting higher. We expect to be able to manage our payments in a way that suits us. And with continuing financial pressures on most UK households, supporters want the ability to easily amend their direct debit donations. With Woods Valldata you have instant access to your supporter details giving you the functionality to add new supporter contacts, cancel and amend existing DDs and view direct debit history so you can make their required changes there and then.

9. Business continuity reassurance

What happens if the system is down? Missing a DD payment can mean a loss of thousands for your charity. It’s imperative that you submit your DDs on the right day for the right supporters without fail. So what measures are in place for business continuity? Check with your provider that their claims are always on, regardless of the situation, and that they have proper insurance in place for the most unforeseen circumstances.

Speed of direct debit migration

It might seem like a daunting task to migrate your direct debits from one provider to another and this can often be a barrier to change. But it’s easier than you might think to take advantage of the benefits a change could bring.

“The transition between claims has been seamless with no impact to our Direct Debit income. We can now offer our donors more than just the two claim dates we originally had and we have Woods Valldata’s Direct Debit expertise and a solid platform in which our Direct Debits are being managed.” Stel Kyriacou, Senior Operations Manager, RNIB

In just 4 weeks you could be up and running with Woods Valldata with a full migration taking advantage of all of the above and more in just 8 weeks. It’s a tried and tested process using PRINCE2 methodologies led by a team of business analysts and your own account managers handling the process – making it as hassle free as possible for you and your team.

We’re proven in our field. An approved Bacs Direct Debit Bureau, we manage and process payment for paper and paperless DDIs on behalf of UK charities equating to £80 million in regular giving donations.

“We transitioned over our DD processing to Woods Valldata in April 2019. The migration project and now the DD management process is working very well for us. I highly recommend working with the team at Woods Valldata.” Tillat Kadri, Fundraising Database Manager, Alzheimer’s Society

Find out more about how we can elevate your direct debit offering to enhance your regular giving income potential. Book your meeting now.

Categories

- charity fundraising (55)

- Income Generation for Charities (43)

- Lottery (41)

- Raffle (37)

- Appeal response handling (33)

- Response Handling (31)

- fundraising insights (24)

- charity gaming (20)

- Fulfilment (18)

- charity insights (17)

- charity raffle (17)

- Compliance (12)

- creating a fundraising strategy (12)

- Company News (11)

- benchmarks (10)

- Direct Debit (9)

- Services (8)

- Gambling Act (5)

- supporter experience (1)

Archives

- March 2020 (5)

- May 2022 (4)

- October 2022 (4)

- January 2023 (4)

- June 2023 (4)

- May 2024 (4)

- June 2024 (4)

- January 2026 (4)

- March 2021 (3)

- April 2021 (3)

- July 2023 (3)

- August 2023 (3)

- April 2024 (3)

- July 2024 (3)

- November 2025 (3)

- June 2020 (2)

- August 2020 (2)

- October 2020 (2)

- November 2020 (2)

- November 2021 (2)

- January 2022 (2)

- February 2022 (2)

- February 2023 (2)

- March 2023 (2)

- September 2023 (2)

- December 2023 (2)

- February 2024 (2)

- March 2024 (2)

- February 2025 (2)

- July 2025 (2)

- December 2025 (2)

- June 2015 (1)

- November 2017 (1)

- February 2020 (1)

- April 2020 (1)

- May 2020 (1)

- July 2020 (1)

- September 2020 (1)

- May 2021 (1)

- June 2021 (1)

- August 2021 (1)

- September 2021 (1)

- October 2021 (1)

- December 2021 (1)

- March 2022 (1)

- April 2022 (1)

- June 2022 (1)

- July 2022 (1)

- August 2022 (1)

- September 2022 (1)

- December 2022 (1)

- May 2023 (1)

- October 2023 (1)

- November 2023 (1)

- January 2024 (1)

- September 2024 (1)

- January 2025 (1)

- March 2025 (1)

- September 2025 (1)

- October 2025 (1)

- February 2026 (1)